Engines of Growth: What Is a Retention Rate?

Paid, retention, viral.

Those are the three “engines of growth” suggested by Eric Ries in The Startup Way. Companies can pick one of the three to be great at, but they generally can’t manage more than that.

Why? How do these engines work with your innovation strategy? How do they differ and what are their limitations?

This is the first of three posts on these engines, starting with retention. I’ll explain each with some basic Innovation Accounting. There will be math, but do not panic! I will crunch the numbers for you.

Retention

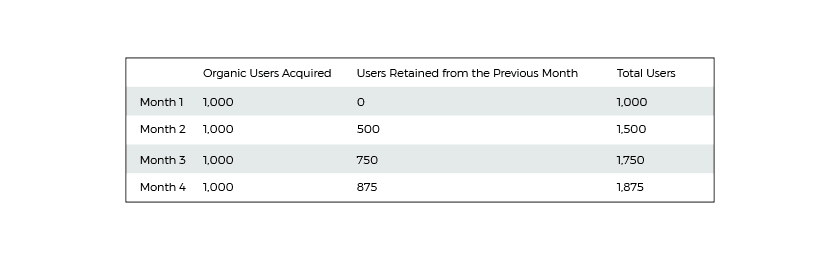

Retention is a great engine of growth for early-stage innovation projects. If we acquire 1,000 customers each month and retain 50% of them, we wind up getting much more than 1,000 per month.

We will double our number of customers within 12 months — an annual growth rate of 100%. That’s certainly impressive.

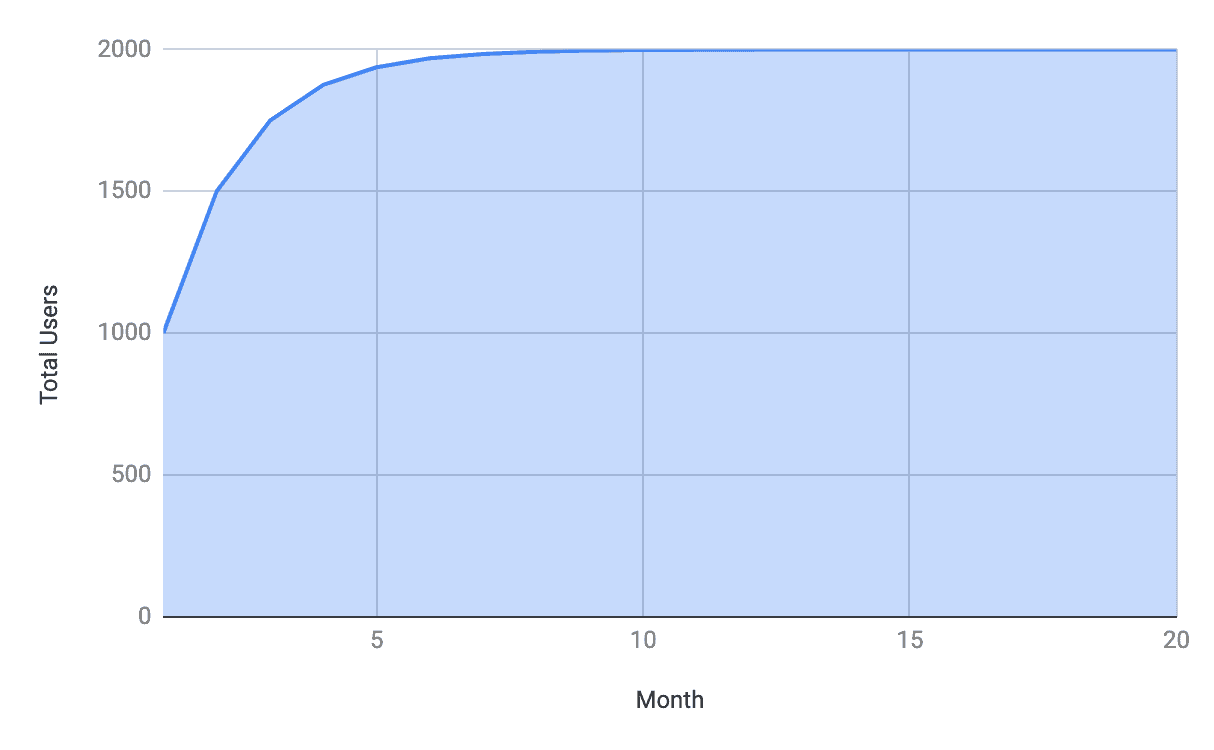

We can use the same logic from our table above to draw a graph with a spreadsheet and see this growth over time. Organic Users Acquired (1000 per month) + Users Retained from the Previous Month = Total Users.

This is a self-reinforcing loop. As the Total Users goes up, the Users Retained goes up; and the more Users we retain, the higher number of Total Users.

But here’s the problem:

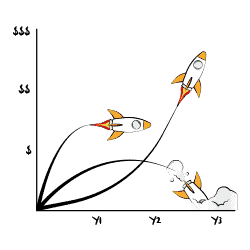

This is not the hockey stick graph that young tech startups look for.

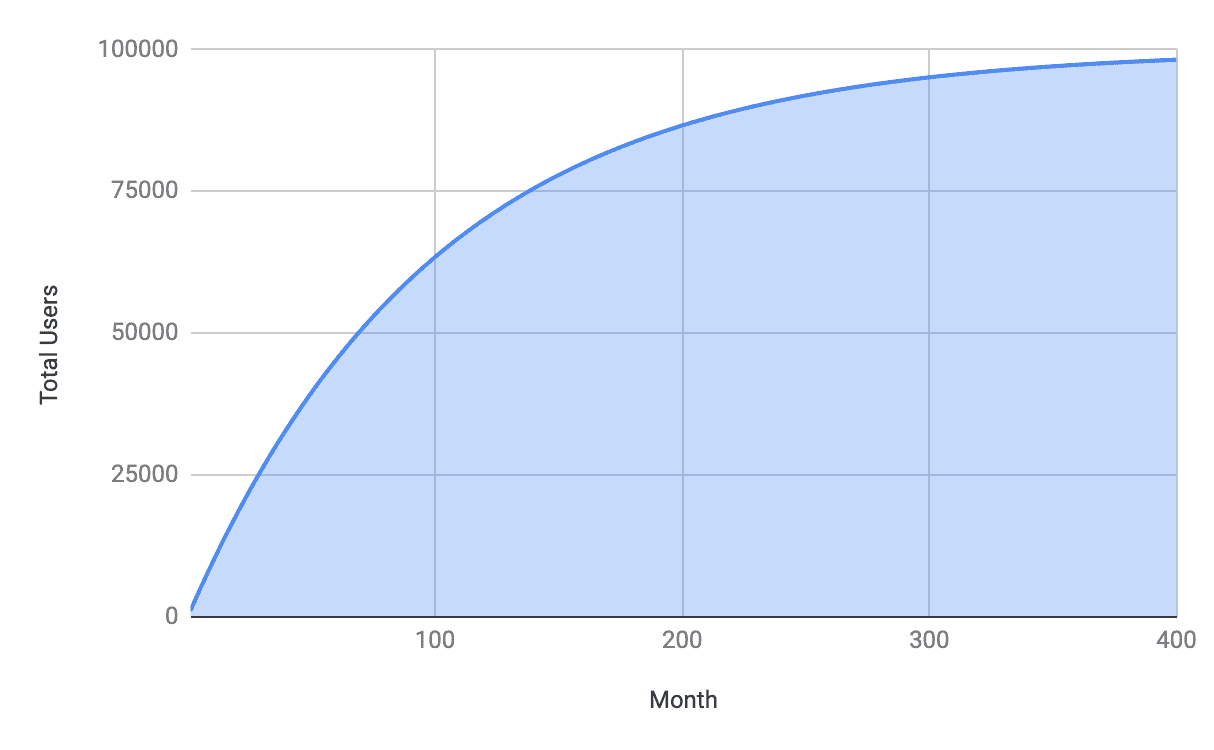

While this may be a profitable and sustainable business, it has limited growth. Growth via retention approaches a limit that it cannot escape. It simply comes down to the math.

If acquisition is happening at a fixed organic rate, and there are no other engines of growth operating, then retention alone will never result in exponential growth. Even a company with 99% retention will approach a maximum limit (also known as an asymptote) over a long enough period of time.

Only companies with a retention rate of 100% can achieve unlimited growth. But the only places with 100% retention rates are the IRS and the graveyard, and even the former eventually loses its customers to the latter.

Companies that seek exponential growth can never achieve their goal with retention alone. There has to be another engine of growth. Retention Needs Acquisition

Retention is less an engine of growth than an amplifier of growth. A startup with 100% retention but 0% acquisition will retain every user it gets, but will have zero users forever because it never acquires any in the first place.

The axiom is true: it’s easier to keep existing customers than to acquire new ones. But a startup with no user acquisition strategy cannot rely on retention to drive growth. Retention only allows you to keep what you’ve fought for. It always makes sense to try to keep your customers, but we cannot grow without user acquisition.

Level of Ambition

This is not to say that retention isn’t a valuable focus for a company. A company with a 99% retention rate is probably a company worth investing in. But of course, most companies never achieve that level of retention.

Take streaming services, a wildly popular domain whose retention rates are relatively high. But the most popular ones, Disney+ and Netflix, only have retention rates of 74%. Even the most loyalty-driven industries — media and professional services — only hang on to 84% of their customers.

But whether retention is a sufficient engine of growth or not depends on the startup’s level of ambition.

If the goal is to achieve the unlimited growth of an exponential hockey stick, then retention alone will not do it. If the goals are to be sustainable, to have an impact, and to be profitable, then retention may be sufficient.

We can even calculate what level of retention will be necessary to achieve an arbitrary goal within a specific time period.

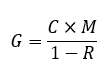

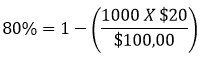

Over time, the revenue-per-month will converge to a maximum limit (asymptote) as we mentioned above. So we can construct a general formula to determine the exact limit of revenue-per-month based on any given retention rate.

(Here comes the math, or you can just take my word for it and skip to where it says “That’s it for the math” below.)

C : Monthly Customer acquisition

M : Monthly revenue per user

G : Monthly revenue Goal

R : Desired Retention rate

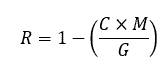

Flipping this equation around to solve for the retention rate, we get:

So if a company earns $20 per user per month, and acquires 1,000 users per month, with a goal of earning $100,000 per month, then we need an 80% retention rate to hit that target. A challenging, but not impossible target to hit.

That’s it for the math!

For those less inclined to do your own math, no worries! Just use trial and error on a spreadsheet like our basic financial modeling template. Set the referral metric to 0% to focus on retention. Then put in different numbers for retention until you see the revenue per month equal or exceed $100,000 per month.

We could also modify this formula if our level of ambition requires us to reach that level of revenue by a specific date.

Experiments with Retention

By setting our level of ambition, we can also set specific goals for our metrics. This gives us a very specific target for retention that we can then run experiments on.

If we have determined that our retention rate required for a given level of ambition is 50%, and we run an experiment to determine that our retention rate is actually 30%, we have a clear business model failure.

At this point, we have a few “official” lean startup options:

- Persevere – Continue running experiments to improve the retention rate.

- Pivot – Choose a different engine of growth.

- Kill – We will not achieve our level of ambition. Let it die.

Adjust Expectations

At the risk of angering the tech community that sees anything less than exponential growth as an utter failure, there is another, “unofficial” option: we can change our level of ambition.

Exponential growth is not exactly a goal if the endpoint is not defined. It is unlimited growth for unlimited ambition. The goal is not specific and achievable, it is growth for the sake of growth. This level of ambition is not satisfied with three Tesla roadsters — there is always room for a ‘vette in the garage. And if there isn’t room, you can afford a bigger garage.

But at some point, earning another million (or even billion) dollars has diminishing returns. You can only drive one car at a time.

As an engine of growth, retention is often the easiest of the three — retaining a customer is easier than acquiring a new one. But retention alone will always result in limited growth. Consider your level of ambition and be honest with what will satisfy you. If retention alone will not achieve your ambition, then a pivot is required.

It’s a good idea to set goals before running experiments, when we’re calm, collected, and rational. It’s generally a bad idea to adjust expectations after seeing the data — that behavior leads to a false-positive bias. But if your ambition is to make $10 million dollars per month and you’re only making $5 million, isn’t that enough?

If you are of the “growth is the only economic imperative” mindset, consider this from a mission-impact perspective instead. If your ambition was to save 1,000,000 lives per year and you only saved 500,000, is that not enough to persevere?

From the for-profit perspective, if you are only earning enough to support yourself, your family, your employees, and your community, isn’t that also a worthy accomplishment?

Consider goals carefully and be honest with yourself about what would actually be sufficient — before you do the math!

Lessons Learned

- Math is cool.

- Retention alone results in limited growth.

- Set your level of ambition and calculate your required metrics.

- If you don’t like math, just use trial and error on a spreadsheet.

- Remember to make clear Persevere, Pivot, or Kill decisions.