Fundamentals of Metered Funding & Stage Gates for Innovation

About the Episode

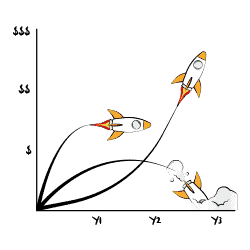

Elijah Eilert speaks to Tristan Kromer about the fundamentals of a VC-like funding approach for corporate innovation that releases resources over time in exchange for specific evidence. Funding a startup or corporate venture from idea to scale is becoming increasingly outdated. Applying traditional stage-gate funding models for innovation projects come with a set of issues on their own. Discover the fundamentals of what Eric Ries calls Metered Funding and how to design an effective incremental funding approach for innovation.

Ideally, each decision point or gate is dictated by uncertainty. In reality, it does not really matter if the uncertainty relates to Desirability, Feasibility or Viability. If innovation accounting techniques are applied we can quantify where exactly the uncertainty lies. Otherwise, designing the first gate around desirability is probably a good bet. As for the vast majority of cases, a lack of customer understanding is the biggest risk.

Topics and Insights

- (02:00) Elijah skips talking about problems associated with funding a project from idea to scale, preferring to start by discussing the common issues with stage-gate funding specifically for innovation projects.

- (05:30) Introducing the basics of metered funding/stage gates which are based on impact, not ticking boxes or entitlement funding.

- (06:00) How to call decision points in the innovation funnel and who oversees them – stages gates, phase gates, scales gates, stakeholder meetings, innovation committee, steering committee, investment boards, innovation boards, investor board, growth board and so on.

- (08:00) Using the analogy for innovation boards being gas stations at a decision point/stage gates. By default, innovators run out of resources – gas/petrol. The gas station gets paid in the form of valuable information that the project is good, i.e. it delivers value and can therefore fuel up again.

- (10:00) On the term “scale gates”, what it implies, the fact that Elijah may be the only one who has adopted it and broccoli flavoured ice cream is mentioned!

- (16:00) Common names and concepts for decision points. Typically four stages are used. The Corporate Startup book provides one of the best ‘off the shelf’ solutions for creating scale gates.

- (20:00) Designing the right decision points (gates) depends on the type of innovation and industry we are looking at.

- (21:45) Any system needs to have adequate desirability, feasibility and viability. Validating these should ideally be prioritised by risk and nothing else. In most cases, desirability is the riskiest factor.

- (26:00) Brief overview and classification of innovation – Core, Adjacent & Transformational and whether they need a different funding system.

- (27:00) The reasons for different management approaches to innovation for managers and organisations as a whole may be different. Organisations long for better predictability and managers may also want to change the culture.

- (28:00) 99% of the time, customer demand is the biggest risk and it should usually be the first decision point. Ideally, the financial model is based on ranges for each variable. The model needs to inform us

- if it is at least theoretically possible to get a certain amount of ROI;

- what the most uncertain variable is. This uncertain variable would be ‘the first gate’ and again, it is usually driven by a lack of consumer understanding – Desirability.

- (34:47) For ideas that are not going to work there is a way to quantify earlier by utilising innovation accounting.

- (37:02) Gates and their specific order is always simplifying something and in place to give people something they can understand and work towards. Any system needs to be flexible enough to override if required.

- (40:20) Discussing the point when a predictive model makes sense, i.e. how early.

- (46:15) We finally found one thing that does not make sense to be quantified – Founder-Market-Fit i.e. “do founders care about the problem they are working on?” For corporates, it is important to assign the right team to the right project.

- (53:15) Recap

Show Transcript

About the Guest

As the founder of Kromatic, Tristan works with innovation teams and leaders to create amazing products and build innovation ecosystems.

Tristan has worked with more than 30 technology accelerator programs, including government-funded initiatives such as Innovation Norway, Vinnova (Sweden), Enterprise Ireland, NEST’up (Belgium), StartSmart (Estonia), and the Innovation Partnership Program (Vietnam-Finland). He has designed lean startup programs such as the Build or Die Bootcamp for TechBA (Mexico) and the Boom Reactor (Belgium) in addition to being part of Luxr, whose Core Curriculum has been used by 13 accelerators internationally, including Singularity University, 500 Startups, & The United States Innovation Fellows.

He has worked with companies ranging from early stage startups with zero revenue to established businesses with >$10M USD revenue (Kiva, Cancer Research U.K., TES) to enterprise companies with >$50B USD revenue (Unilever, Swisscom, Salesforce, Fujitsu, LinkedIn).

Tristan regularly speaks, appears on panels, and gives workshops internationally with organizations such as the Stanford Center for Entrepreneurial Studies & D-school, Global Product Management Talks, Lean Startup Machine, General Electric (GE), and more.

With his remaining hours, Tristan volunteers his time with early stage startups.

Originally from New York City, he has lived in Germany, Switzerland, Taiwan, and Vietnam, and currently resides in San Francisco, USA.

Connect with Tristan

RELATED INNOVATION WORKSHOPS & TRAINING