Innovation Accounting Training Program

Make better and more confident decisions for your venture earlier!

Innovation Accounting Program Overview

Innovation teams that have done qualitative research and collected data from early user testing but need to show Product/Market-Fit and project viability in a quantitative way will greatly benefit from this program.

You will learn how to turn qualitative findings into quantitative predictions and take home a financial model even for an early project with high uncertainty. The model will calculate the most likely project outcome and help you define your next experiment. Business Cases for startups and corporate innovation initiatives are notoriously unreliable. But instead of throwing them away entirely, this program will give you a competitive advantage by making better decisions earlier, leveraging innovation accounting!

“For innovators and UXers who are overwhelmed by having to think about finances and accounting and want to learn something applicable to the business context, I would recommend this course. You learn how to construct a model that makes sense for innovators and other parts of the business to facilitate a meaningful conversation.”

My team found the program highly engaging, interactive and very hands-on. The program introduced concepts outside of the standard forecast process which helped to better assess the viability of new projects. This is very useful in an environment of limited resources. A great course for building analytical capabilities!

“The financial modelling provided by Innovation Metrics is the first major advancement in how Startup financial modelling is done since Excel was invented.”

“Coming from a Finance/Accounting background I found the Storyboarding Module very helpful in learning a different way to ascertain and then explain how value is being generated.”

What you get from the innovation accounting program?

- A storyboard or journey map representing your user’s experience

- Clear quantitative metrics to measure your user’s experience

- A statistical simulation of the most likely outcome of your business or mission impact model

- Recognise the levers of growth for your business model and how to take advantage of them

- A sensitivity analysis showing the most impactful factors in your financial or mission impact model, knowing what to learn next

- Clear criteria to make a go/no-go decision

How it is innovation accounting program delivered?

- Interactive kickoff to introduce the topics and program experience.

- Each module contains a self paced element including learning material items such as:

- Video lectures

- Templates

- Interactive materials or games

- Other supplementary materials

- One year access to all self-paced material for the selected modules including any upgrades.

- Each module contains an 2 hour interactive online session to work on real examples in a peer group with facilitators.

- The Monte Carlo Simulation module will consist of two 2-hour interactive online sessions instead of recorded video lectures.

- Unlimited Q&A support during the enrollment month period with email and video responses or in person online.

- Certificates of completion for all program attendees.

When does the next innovation accounting program start?

| ASIA PACIFIC / US | US / EUROPE |

|---|---|

|

|

“The financial modelling provided by Innovation Metrics is the first major advancement in how Startup financial modelling is done since Excel was invented.”

Why a different approach to traditional financial modelling?

The vast majority of startups and innovation projects have historically not delivered what was initially promised. Many organisations have and will continue to lose money, or have not had the desired impact with their innovation projects. Accounting and the way we do financial modelling plays a huge role in this.

Traditional financial modelling aims to calculate things like Return on Investment (ROI), Net Present Value (NPV), and so on, many years into the future. For innovation projects, these calculations are very inaccurate as they are built on layers of data-poor assumptions.

To be fair, facts are hard to come by as innovation projects and startups are by definition doing something that is new. Therefore, conventional accounting has very little historical data as it is familiar with handling well. Everybody who has allocated or asked for resources for high-risk ventures knows this. The risk is often clear enough but managed in a way that can introduce even more risk.

High-discount rates for future cash flow is one of these examples. While intended to mitigate risk, it sets a higher bar for startups or corporate innovation projects. Any experienced person driving an uncertain venture is familiar with this process. In an attempt to make sure resources can still be secured, these in/entrepreneurs know that they have to present higher predictions than initially calculated. This makes it less likely to achieve a certain target and all too often uses even more resources. It is one example of how applying well-trusted tools in an environment of high uncertainty is not helpful — and even counterproductive — for everyone involved.

Innovation Accounting is designed to fill the gap where standard accounting falls short.

Innovation Accounting – Bridging the Gap between Innovators and Finance

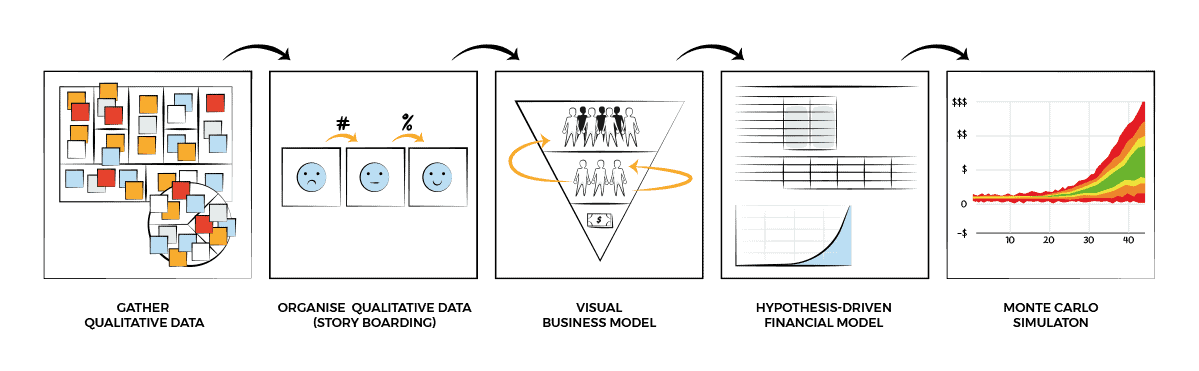

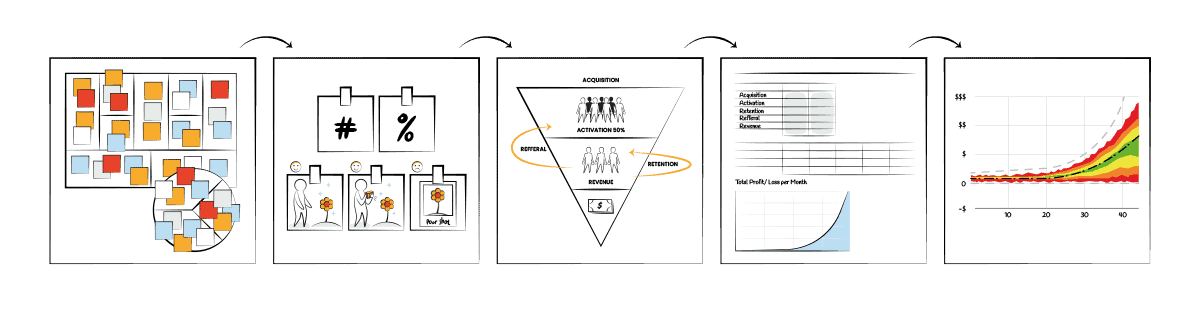

Getting from early research and mostly qualitative data to a financial model that assist the team and satisfies finance is hard if possible at all with traditional modelling and accounting methods. The innovation accounting approach visualised below is a step by step process to make this possible.

This course, teach you how to extract from even early-stage projects with mostly qualitative and few historical data the right metrics. Leveraging the Pirate Metrics for Startups approach you will identify and understand all the actionable metrics and lead indicators for success and avoid vanity metrics.

In the next step, you will learn how to use a visual financial model using the metrics identified in the previous step before using a spreadsheet (templates are provided) for the first time again drawing on the outcome of the previous lesson.

Lastly, we will guide you through how to express each variable within a confidence interval/range to enable a Monte Carlo Simulation. This statistical approach results in the best possible prediction for your model. Lastly, we will see how the analysis can help with a range of decision making and what to do next.

The approach, different from traditional financial modelling, identifies a venture’s key risks, levers of growth, and potential much more objectively than any traditional business case.

“Coming from a Finance/Accounting background I found the storyboarding module very helpful in learning a different way to ascertain and then explain how value is being generated.”