What Is Innovation Accounting?

Innovation Accounting sounds like one of those semi-humorous oxymorons like “accurate rumors,” “the rules of anarchy,” or “airline schedules.”

Innovation sounds exciting! It’s about ideas and novelty. Things we’ve never seen before. It’s ambiguous and full of uncertainty. It’s mysterious and seems utterly unquantifiable.

Accounting is the thing you dread doing at tax time. It’s all about numbers, it involves spreadsheets, and (unless you’re a geek like me) it threatens to bore you into submission.

Marrying the words together forms an inscrutable and ambiguous concept that is all the rage in innovation departments, but few are entirely sure what it is or how to do it.

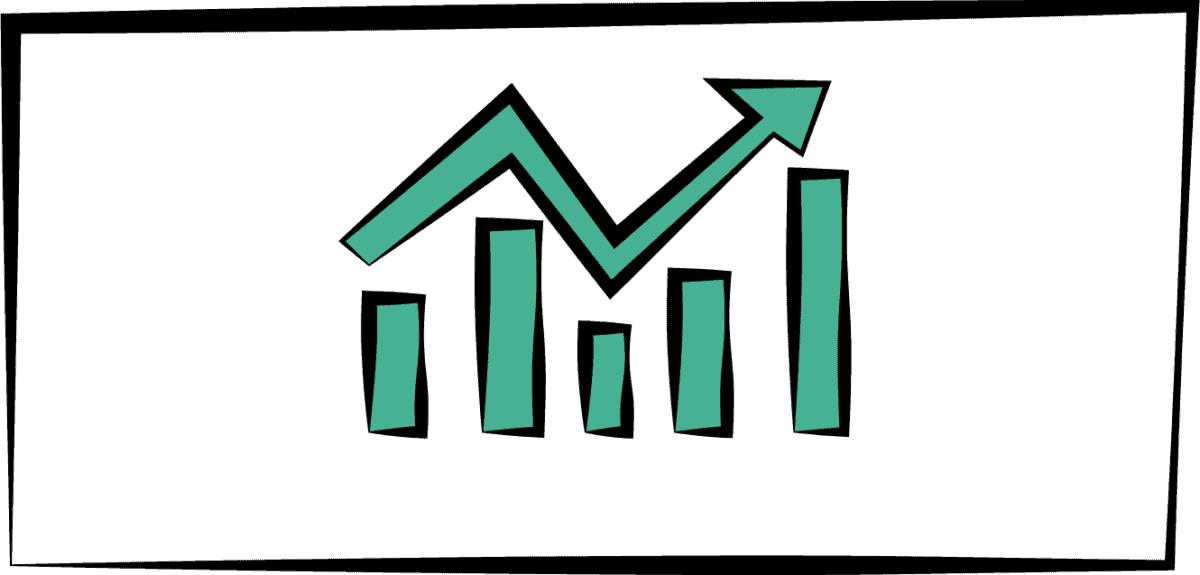

But here’s the promise: Innovation accounting allows us to quantify the progress of a risky project in an uncertain domain. It will also allow us to determine if a project is worth investing resources in.

In other words, dull or not, it’s a useful tool for monitoring your innovation ecosystem.

The History of Innovation Accounting

How did we get into a situation where everyone is using a term that few understand?

Eric Ries brought the term into our collective vocabulary in the Lean Startup book, defining the term as “…a way of evaluating progress when all the metrics typically used in an established company (revenue, customers, ROI, market share) are effectively zero.”

Essentially, Eric was proposing a way to measure the success or failure of innovation projects before lagging financial metrics such as revenue or ROI are available. This is the holy grail of innovation: being able to, in the first months or even weeks of a project’s life, tell if it will succeed.

But the methodology of how to actually do that was largely unexplored and unexplained. Compounding this lack of detail is the general consensus among VPs of innovation that innovation accounting must not only tell us whether an individual project is succeeding, but also make it clear whether or not the innovation department is doing a good job. Because at the end of the day, if the innovation department can’t point to a number and show that it’s going in the right direction, there won’t be an innovation department for long.

Innovation departments need to be able to not only measure the potential ROI of a specific project, but also measure the potential of the company to generate projects with ROI. And since early indicators of project success are unclear, undefined, and undiscovered, innovation departments went a different route. Instead of seeking early indicators of success for a project, they sought early indicators of success in the team itself. Could the skill of the team be a leading indicator? Can we measure a “culture of innovation?” Can we measure our innovation ecosystem?

We can also look at innovation pipeline metrics. How many ideas are there? How many projects discover a true market need? How many are able to create a product that fulfills that need? Even if project progress is measured by subjective guesses, it’s at least an attempt at measurement, and it’s better than nothing.

These attempts to find valid metrics are reasonable next steps to take, especially when innovation departments are under pressure to show how their activities result in bottom line results. Thus, the term “innovation accounting” has become a catch-all for measuring innovation in a project, in a portfolio, and in an organization.

Thus, innovation accounting and its methods are just ambiguous enough so everyone can have their own definition, which is why such little progress has been made to truly measure innovation.

Decisions, Not Numbers

Measuring innovation should not be something we just do to fill a PowerPoint slide. Although innovation departments have to show their value, the true measure of a metric is what actions we take. For example, when we say, “We need innovation accounting,” we are really demanding an answer to the question, “Which projects are going to succeed?”

We are asking that question because we need to make a decision, Should we continue this project or not? Is it worth investing in? Or is this other project a better bet?

Companies have limited resources. Regardless of their size, they always have at least twice the number of innovation projects as people to execute on them. They need to understand which projects have the best chance of success so they can prioritize.

Similarly, innovation departments want to measure the effectiveness of their workshops, coaching, and skill training, because someone in the company wants to make another decision: “Should the VP of Innovation keep their job?”

Even individual team owners focus on innovation accounting because they are trying to make a decision: “Should I assign this project to these intrapreneurs or to someone else? Do they have the skills to succeed?”

Essentially, we want a business case to make each decision on how to allocate resources.

Unsurprisingly, all these decisions involve money. They are about:

- Investing in an individual innovation project.

- Investing in an innovation strategy across a portfolio of projects.

- Investing in innovation capabilities.

The first is about investing in a project in order to receive an ROI. It is about allocating resources to a specific team with a specific idea. It is about revenue and profit.

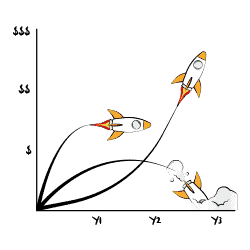

The second is about systematically investing in a strategic thesis. It is not about investing in an individual project, but in a portfolio of projects which the company can choose to scale or not. It is about generating options. Specifically, innovation options.

The third is about investing in the capabilities to run more projects more quickly and for less money. Therefore it is about cost.

These innovation investment decisions rely on having sufficient information at each level of the organization that I mentioned in a previous post:

- Individuals.

- Teams.

- Projects.

- Portfolio.

- Ecosystem.

Lining up these levels with the decisions we need to make, we get some specific questions we need to answer:

- Investing in an innovation project

- Projects – Should we invest in this project or not? What will the Return on Investment (ROI) be?

- Teams – Is this the right team for this project? Should I trust the information that the innovation team is giving me to make the project innovation investment decision?

- Investing in an innovation strategy

- Portfolio – Should we continue to invest in projects in these areas? Are we sufficiently diversified?

- Investing in innovation capabilities

- Individuals – Should we invest in upskilling our employees and teams? What critical competencies are we lacking?

- Ecosystem – How can we expand the number of entrepreneurs? How can we reduce the obstacles to innovation? How can we reduce the cost of innovation?

Centering innovation accounting around decisions that need to be made finally allows us to get to a pragmatic definition of the term.

What Is Innovation Accounting?

Innovation accounting is a method of quantifying the uncertain impact of investments in individual projects, strategies, and capabilities.

Traditional financial accounting is about the past. Innovation accounting is about the future. While traditional financial accounting looks backward and tabulates the impact of decisions that have already been made, innovation accounting looks forward and predicts the value of things that have not yet happened and may never happen.

Innovation accounting helps us make decisions in the present about whether certain courses of action will offer value in the future.

Innovation Accounting Must Quantify

I love qualitative data. I would rather subjectively judge the softness of a beach and the warmth of the sun than know precisely how many grains of sand there are or exactly what percentage of my body I forgot to put sunscreen on.

But there’s a limit to the usefulness of qualitative data. If innovation accounting doesn’t get us to quantitative data (a.k.a numbers), then it’s not doing its job.

Qualitative data is great for making quick broad decisions. If we’re deciding between investing in blockchain vs. Consumer Packaged Goods (CPG), we don’t need an extensive quantitative analysis. Do we have the skills necessary to succeed in blockchain? If not, but we have the skills for CPG, go for CPG instead.

But if we’re deciding between two different projects within the same domain, potentially solving similar customer needs, we need a more precise approach. If two people with two different qualitative assessments disagree, we must have quantitative measures to resolve the conflict.

Innovation accounting must provide an objective set of facts. In traditional financial accounting, if we count 17 one-dollar bills, that is $17. No one can disagree and claim that their qualitative assessment is that the value is $18.

If innovation accounting leaves us with only qualitative subjective assessments, it has ultimately failed its promise.

Innovation Accounting Must Decide

If innovation accounting just generates dashboards of numbers that don’t help us make decisions, then it is ultimately just theater. Numbers go up and numbers go down, dancing all over a PowerPoint presentation. But without purpose, all is vanity.

We have real decisions to make, and an innovation accounting system should help us make those decisions the same way a real accounting system does.

Innovation funnel metrics may tell us we have 100 projects at the concept stage, 50 in the market research stage, and 20 in the prototype stage, but that doesn’t tell us if our strategy is working.

Are those 20 projects in the prototype stage aligned with our strategy of investing in disruptive innovation? Are they even really innovation projects? Or do we just have 20 variations on the theme of changing our company slogan? These metrics don’t even tell us if “We make stuff good!” is the best our marketing department can come up with.

Innovation Accounting Must Cover Projects, Strategy, and Capabilities

Making great decisions on individual projects doesn’t create a cohesive strategy. One project on blockchain, another on CBD scented candles, and another on freezerless ice cream may sound great individually, but pursuing them all is a bad strategy. There is no company that is going to be great at producing all of these things simultaneously.

Even if we know that our strategy is sound and our portfolio of projects will help us corner the scented candle market, that’s useless if our company is packed with blockchain experts who suffer from hyperosmia (sensitivity to strong smells).

A strategy is useless if we don’t have the capabilities to successfully execute it. Being able to value an individual innovation project is a starting point. But a complete system of innovation accounting must encompass projects, strategy, and capabilities to truly give us a view of the future.

Lessons Learned

Remember: Innovation accounting is a method for quantifying innovation investment decisions about individual projects, strategy, and capabilities. It’s an attempt to find leading indicators for success, not only for a product, but for a company.

We’re still far from a system of innovation accounting that will complete Generally Acceptable Accounting Practices (GAAP), but we know what such a system will look like:

- Innovation accounting must be quantitative….

- …must help us make decisions…

- …and should include metrics for projects, strategy, and capabilities.