The Innovation Accountant

Innovation accounting is an emerging discipline aimed at improving the poor track record of predicting outcomes and tracking progress for innovation projects. Traditional accounting methods are not equipped to handle the absence of historical data inherent to innovation.

Despite the crucial role for any type of accounting it generally doesn’t stir much enthusiasm. The solution to a rigorous implementation may well be to create a dedicated role for an Innovation Accountant. After all, that’s what organisations do for other accounting tasks they take seriously.

To assist in developing this capability within your organisation, this article begins with a brief introduction to innovation accounting. It then offers a list of the skills and responsibilities required of an innovation accountant.

Innovation Accounting

The Problem

Most people perceive innovation as fun and exciting. True or not, entrepreneurs and intrapreneurs need to do a lot more than be creative in order to be successful. At some point, they inevitably need to justify resource allocation and report on progress to corporate sponsors or investors. In most corporate settings, business cases are the standard tool for these tasks — but they don’t work for uncertain high-risk high-reward innovation projects.

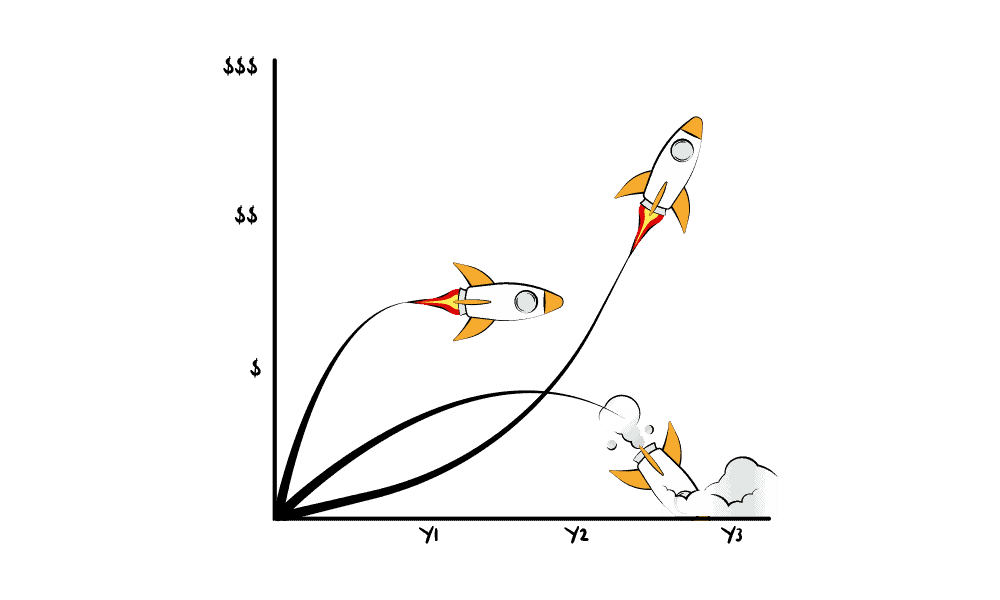

Business cases for innovation projects lure with high returns but most of the time fail to deliver on that promise, or, worse still, waste the entire investment. On rare occasions, some projects significantly outperform even the most optimistic early predictions. Although pretending to, business cases never predict the future accurately, as they are not designed for high amounts of uncertainty inherent to, if not defining innovation.

Tried and tested methods such as calculating Net Present Value (NPV) in the early stages of an idea are highly inaccurate because innovators are asked to predict precise numbers for an indeterminate unknown future. Being forced to estimate in this way while having to overcome the CFO’s high discount rates as the preferred corporate method of adjusting for risk, compromises veracity and hides the true uncertainty. The underlying assumptions or variables in these models are not practically testable. NPV and its siblings are all lagging indicators, they only provide the ability to make better decisions when it is too late and most of the investment has been spent.

For a full explanation, please read Innovation Accounting: The Failure of the Business Case.

The Solution

The solution to this problem is innovation accounting – a discipline designed for uncertain ideas to more accurately and honestly predict the future through probabilistic modelling based on testable variables and the ability to quantify uncertainty.

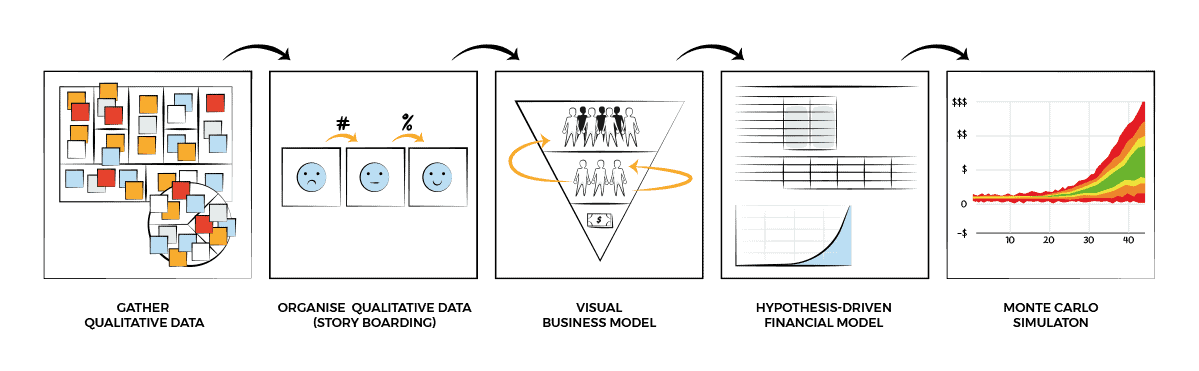

Innovation accounting is neither magical nor complicated, one does not require a Ph.D. in Mathematics to make use of it. The innovation accounting process may require some teamwork and upskilling but it is essentially a combination and adaptation of proven methods. The key elements are:

- Storyboarding – to extract relevant observable and measurable metrics based on anticipated customer behaviour.

- Visual Business Modeling – to quantify and understand the friction points and loops within a business model as a consequence of anticipated observable customer behaviours.

- Hypothesis-Driven Financial Modelling – to build a model that looks into the future, based on key measurable and observable assumptions.

- Monte Carlo Simulation – to create a probabilistic model that takes into account the relationships between variables i.e. loops, such as retention and referral rates as well as the true uncertainty of each assumption and the entire model. Join our innovation accounting program to receive your template.

For a full explanation, please read – Innovation Accounting in Practice.

The Innovation Accountant

Innovation accounting requires a particular skill set, similar to preparing and interpreting management accounting reports, building traditional financial models, auditing and so on.

The responsibilities and skills outlined below represent an initial effort to delineate the roles and responsibilities inherent to the position of an innovation accountant.

Responsibilities

- Estimating: Forecast a range of possible results, from monetary gains such as revenue to non-monetary impacts like carbon footprint reduction.

- Calculating the likelihood of achieving specified targets: Assessing the probability of reaching set objectives.

- Creating a prioritized ranking of key uncertain variables: Identifying and ordering the variables with the most significant impact on a model’s outcomes to focus efforts on areas where information can most improve decision-making.

- Estimating the value of additional information: Quantifying how much new insights for a particular variable or the entire forecast would be worth.

- Facilitating the interpretation and communication of results: Bridging the gap between innovation teams and finance or investment boards.

- Assisting in the interpretation of experimentation and research outcomes: Providing expertise to teams and managers on how to understand and leverage results from experiments and research initiatives for informed decision-making.

- Guiding teams in setting success and failure criteria for experiments: Offering guidance on establishing clear, measurable criteria for evaluating the outcomes of innovation experiments, fostering a structured approach to learning and iteration.

- Advising innovation boards on resource allocation: Advising on the resources necessary for teams to run experiments and gather additional insights enabling the board to make more informed decisions

- Supporting the development and maintenance of an innovation governance and reporting structure: Contributing to the creation of systems and processes that ensure accountability and transparency to govern innovation projects.

Depending on the innovation maturity of the organisation, not all responsibilities may apply.

Skills

- Capability to identify observable and testable metrics: Skill in identifying measurable indicators for financial and mission impact assessments through storyboarding.

- Proficiency in hypothesis-driven financial and mission impact modelling: Ability to create models based on specific assumptions and their potential impacts.

- Financial acumen: An understanding of financial principles and their application in varied scenarios.

- Knowledge of Pirate Metrics for Startups and loops in the model: Familiarity with acquisition, activation, retention, referral, and revenue metrics and their relevance specifically in regard to reinforcement loops for the model.

- Proficiency in creating a visual business model: Expertise in visually mapping out the components of a business model to bridge the gap between designers and finance.

- Quantitative Experiments: Competence in designing experiments and interpreting results.

- Qualitative research analysis: Ability to judge the design and glean insights from non-numerical data.

- Spreadsheet proficiency: Expertise in using spreadsheets (at least for now).

- Monte Carlo Simulation expertise: Understanding of when and how to use Monte Carlo Simulations in decision-making processes.

- Understanding of a One-at-a-Time Sensitivity Analysis: Ability to perform and interpret the impact of varying assumptions on model outcomes.

- Understanding probability distributions: Knowledge of how to apply probability distributions to variables within models.

- Valuation of information: Skill in assessing the worth of additional data or insights in decision-making contexts.

- Foundation in Bayes’ theorem and calibration estimation: Grasp of Bayesian reasoning and the ability to estimate probabilities.

- Experimental mindset: Openness to experimentation and learning from failure.

- Collaborative communication: Ability to foster an open sharing between diverse stakeholders.

- Curiosity: A desire to learn and explore new concepts, technologies, and methodologies.

Innovation Accounting: A Team Effort

For large organisations, employing a dedicated innovation accountant is compelling. This doesn’t mean that it is enough for the innovation accountant alone to possess all the skills and do all the work. In large organisations, effective innovation accounting needs collaboration. Its potency amplifies when individuals across the board, including designers, innovation teams, engineers, business analysts, financial professionals, investment committees, and strategists augment their skill sets.

If you are not able to commit to a dedicated role ensuring seamless information dissemination and pinpointing skill shortages, fostering collaboration is paramount. In this case, we usually propose forming a group of subject matter experts who meet regularly.

The end goal remains consistent: better quantification and data-driven decisions to increase the probability of innovation success.

Lessons Learned

- Traditional accounting practices struggle to navigate innovation projects, providing misleading and inaccurate forecasts.

- Innovation accounting addresses the shortcomings of traditional methods by employing probabilistic modelling and testable variables to more accurately predict future outcomes and measure progress.

- The role of an innovation accountant enables sustainable innovation accounting practices in large organisations.

- Innovation accounting demands a specific set of skills.

Don’t miss the article on innovation bookkeeping and innovation bookkeepers and sign up for our newsletter – exciting times ahead!

Appendix

Innovation Accounting – Measuring Innovation in Large Organisations

For large organisations, the challenge of effectively measuring and managing innovation transcends the simple quantification of individual projects. Over the years, the concept of innovation accounting has broadened to encompass a variety of innovation-related measures within an organisation, including:

- Individuals: Tracking the capability of individual employees to innovate.

- Innovation Teams: Assessing the performance of an innovation team.

- Innovation Projects (Corporate Startups): Evaluating the probability of success, funding needs and progress of a single uncertain investment.

- Funnels: Funding, prioritising and monitoring the progression of a backlog of ideas from conception through to implementation.

- Portfolios: Governing a mix of innovation investments and their alignment with strategic objectives.

- Capability: Gauging the organisation’s ability to innovate through skills, processes, and technologies.

- Culture: Measuring the influence of organisational culture on innovation effectiveness.

- Innovation Ecosystems: Analysing the limiting factors between all relevant aspects including external partnerships and networks in driving innovation.

- Innovation Strategy: Estimating the value, funding requirements and progress of innovation strategies.

In the accounting domain, innovation accounting is best understood as a complement to traditional financial, managerial, and cost accounting methods. An innovation accountant, therefore, may take on a diverse range of responsibilities, supporting various stakeholders within the organisation. At its heart, the role focuses on the modelling and reporting of individual investments in innovation.

Please comment below if you like this article to expand and describe the skills and responsibilities needed for innovation accountants supporting any of the above listed areas.

Special thanks to Christopher Karvountzis, Tristan Kromer, Patrick Canny, Jon Ruark and anybody I may have forgotten for reviewing and giving feedback on this post – innovation accounting is a team effort.

RELATED INNOVATION WORKSHOPS & TRAINING